Contents:

Thus, stock dividends lead to the transfer of the amount from the retained earnings account to the common stock account. The amount of income earned over the company’s life minus the dividends paid to shareholders over the company’s life. The amount of income earned over the company’s life minus the distributions or dividends paid to shareholders over the company’s life.

Understanding financial statements: A user guide for Family Lawyers – MNP

Understanding financial statements: A user guide for Family Lawyers.

Posted: Mon, 10 Apr 2023 18:23:01 GMT [source]

Retained earnings are the amount of net income retained by a company. Both revenue and retained earnings can be important in evaluating a company’s financial management. As mentioned earlier, management knows that shareholders prefer receiving dividends. Yet, it may not distribute dividends to stockholders.

Revenue vs. Retained Earnings: An Overview

Which of the following transactions decreases retained earnings? Which of the terms is not used to identify owners‘ equity or stockholders‘ equity? Paid-in-capital and retained earnings. Because expenses have yet to be deducted, revenue is the highest number reported on the income statement. At each reporting date, companies add net income to the retained earnings, net of any deductions.

She has worked in multiple cities covering breaking news, politics, education, and more. Her expertise is in personal finance and investing, and real estate. To learn more, check out our video-based financial modeling courses. Alan Li started writing in 2008 and has seen his work published in newsletters written for the Cecil Street Community Centre in Toronto. He is a graduate of the finance program at the University of Toronto with a Bachelor of Commerce and has additional accreditation from the Canadian Securities Institute.

For instance, a company may declare a stock dividend of 10%, as per which the company would have to issue 0.10 shares for each share held by the existing stockholders. Retained earnings refer to the residual net income or profit after tax which is not distributed as dividends to the shareholders but is reinvested in the business. Typically, the net profit earned by your business entity is either distributed as dividends to shareholders or is retained in the business for its growth and expansion. The retained earnings formula calculates the balance in the retained earnings account at the end of an accounting period.

As such, royalties do appear on the business’s income statement and decrease operating net income for the period. The balance sheet equation is assets plus liabilities equal owners equity or net worth. Net worth includes start-up capital injections, additional capital infusions and retained earnings minus any distributions. Owner equity adjustments typically impact retained earnings unless the owners contribute more equity capital or obtain capital from investors.

A statement of retained earnings statement is a type of financial statement that shows the earnings the company has kept (i.e., retained) over a period of time. Many factors can affect a business’s retained earnings. One is the net income or loss that the company experiences in a given period. If a company has net losses, its retained earnings will decrease. Conversely, net income will boost the company’s retained earnings. Accountants must accurately calculate and track retained earnings because it provides insight into a company’s financial performance over time.

Retained Earnings Formula: Definition, Formula, and Example

When revenue is shown on the income statement, it is reported for a specific period often shorter than one year. A company can pull together internal reports that extend this reporting period, but revenue is often looked at on a monthly, quarterly, or annual basis. For example, companies often prepare comparative income statements to analyze reports over several years. Paid-in capital comprises amounts contributed by shareholders during an equity-raising event.

Retained earnings are also called earnings surplus and represent reserve money, which is available to company management for reinvesting back into the business. When expressed as a percentage of total earnings, it is also called theretention ratio and is equal to (1 – the dividend payout ratio). Retained earnings are the amount of net income left over for the business after it has paid out dividends to its shareholders. DividendsDividends refer to the portion of business earnings paid to the shareholders as gratitude for investing in the company’s equity. Whether the company is retaining its profit or its paying part of profits as dividends.

Ready to calculate your retained earnings?

Retained earnings are the profits that a company generates and keeps, as opposed to distributing among investors in the form of dividends. As with many financial performance measurements, retained earnings calculations must be taken into context. Analysts must assess the company’s general situation before placing too much value on a company’s retained earnings—or its accumulated deficit. Since retained earnings demonstrate profit after all obligations are satisfied, retained earnings show whether the company is genuinely profitable and can invest in itself. Those reinvestments can help boost future profits. Retained earnings are a critical metric for any business.

- Dividends are different from royalties in that they do not impact the corporation’s income statement and thus do not color its performance for the period.

- Revenue sits at the top of the income statement.

- Retained earnings are a type of equity and are therefore reported in the shareholders’ equity section of the balance sheet.

- Investopedia does not include all offers available in the marketplace.

This information can be found on the balance sheet or statement of retained earnings. Understanding how retained earnings relate to financial statements is essential for investors who want to evaluate a company’s profitability and future potential growth opportunities. Both increases and decreases in retained earnings affect the value of shareholders‘ equity. As a result, both retained earnings and shareholders‘ equity are closely watched by investors and analysts since these funds are used to pay shareholders via dividends.

Our Partners

Thus, they are not available to be distributed as the dividends. Do the Calculation of the Retained Earnings using the given financial statements. Retained earnings increase as the company’s net income increases.

- Likewise, a net loss leads to a decrease in the retained earnings of your business.

- It can serve as a blueprint for small business owners.

- Robust announces a 3-for-2 stock split.

- As a result, any items that drive net income higher or push it lower will ultimately affect retained earnings.

- By how much is retained earnings reduced by the property dividend?

With retained earnings, equity members might lose out on dividends. Using this finance source too much can create dissatisfaction among members and impact the goodwill of the firm. A company shouldn’t avoid giving dividends payouts just to amass more retained earnings. Doing so will establish a poor track record.

The money can be used for any possible merger, acquisition, or partnership that leads to improved business prospects. Depreciation, which is the cost of a fixed asset spread out over its useful life. A. The arbitrary dollar amount assigned to a share of stock. B. Losses resulting from the return on pension assets exceeding expectations.

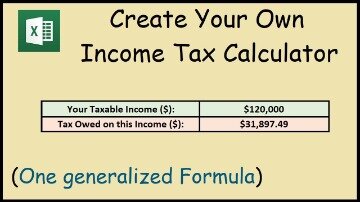

What Is the Retained Earnings Formula and Calculation?

If you’re a small business owner, you can create your retained earnings statement using information from your balance sheet and income statement. The accountant will also consider any changes in the company’s net assets that are not included in profits or losses (i.e., adjustments for depreciation and other non-cash items). Once you consider all these elements, you can determine the retained earnings figure. On one hand, high retained earnings could indicate financial strength since it demonstrates a track record of profitability in previous years. On the other hand, it could be indicative of a company that should consider paying more dividends to its shareholders.

Note that accumulation can lead to more severe consequences in the purchase journal. For example, if you don’t invest in projects or stimulate the interest of investors, your revenue can decrease. Are you unsure what this earning number represents and how to calculate it? This article goes over all the basics.

It might also be because of different financial modelling, or because a business needs more or less working capital. In 2011, Winn, Inc., issued $1 par value common stock for $35 per share. No other common stock transactions occurred until July 31, 2013, when Winn acquired some of the issued shares for $30 per share and retired them.

Where Are Retained Earnings Located in Financial Statements?

By what amount will Fink’s paid-in capital—excess of par increase for this transaction? Retained earnings is the residual value of a company after its expenses have been paid and dividends issued to shareholders. Retained earnings represents the amount of value a company has „saved up“ each year as unspent net income. Should the company decide to have expenses exceed revenue in a future year, the company can draw down retained earnings to cover the shortage.

Condor Gold Announces Its Audited Results for the Year Ended 31 … – EIN News

Condor Gold Announces Its Audited Results for the Year Ended 31 ….

Posted: Tue, 28 Mar 2023 08:04:00 GMT [source]

By subtracting the dividends paid from the net income, you can see how much profit the company has reinvested in itself. By looking at these items, you can understand a company’s performance over time and dividend policy. Many businesses use retained earnings to pay down debt, which can help to improve a company’s financial health and reduce its interest expenses. If you decide to reduce debt, you should prioritize which debts you’ll pay off. Return on equity is a measure of financial performance calculated by dividing net income by shareholders‘ equity. Generally speaking, a company with a negative retained earnings balance would signal weakness because it indicates that the company has experienced losses in one or more previous years.

Which of the following statements correctly states an effect of this acquisition and retirement? Additional paid-in capital is decreased. Retained earnings differ from revenue because they are reported on different financial statements. Retained earnings resides on the balance sheet in the form of residual value of the company, while revenue resides on the income statement.

Remember to do your due diligence and understand the risks involved when investing. Ensure your investment aligns with your company’s long-term goals and core values. Perhaps the most common use of retained earnings is financing expansion efforts. This can include everything from opening new locations to expanding existing ones. For example, during the period from September 2016 through September 2020, Apple Inc.’s stock price rose from around $28 to around $112 per share. The earnings can be used to repay any outstanding loan that the business may owe.

As a result, any items that drive net income higher or push it lower will ultimately affect retained earnings. Revenue, sometimes referred to as gross sales, affects retained earnings since any increases in revenue through sales and investments boost profits or net income. As a result of higher net income, more money is allocated to retained earnings after any money spent on debt reduction, business investment, or dividends. Revenue on the income statement is often a focus for many stakeholders, but the impact of a company’s revenues affects the balance sheet. If the company makes cash sales, a company’s balance sheet reflects higher cash balances.

This allocation does not impact the overall size of the company’s balance sheet, but it does decrease the value of stocks per share. In the next accounting cycle, the RE ending balance from the previous accounting period will now become the retained earnings beginning balance. Balance sheet under the shareholder’s equity section at the end of each accounting period. To calculate RE, the beginning RE balance is added to the net income or reduced by a net loss and then dividend payouts are subtracted. A summary report called a statement of retained earnings is also maintained, outlining the changes in RE for a specific period. The financing section of the cash flow statement captures the cash flows related to financing, which include activities involving liabilities and owner equity.

Retained earnings can be used to shore up finances by paying down debt or adding to cash savings. They can be used to expand existing operations, such as by opening a new storefront in a new city. No matter how they’re used, any profits kept by the business are considered retained earnings.